Financial Services and Fintech

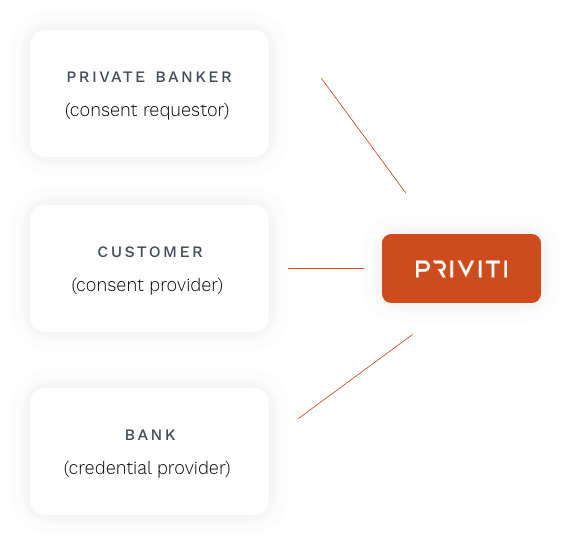

Private banking trade use case

A private banker (consent requestor) sends a trade request to a customer (consent provider) to approve so it can be executed by the bank (credential provider).

- The banker asks the customer, “Can you review this trade request and confirm you would like to proceed?”

- Customer receives the request and gives authenticated consent via Priviti.

- Priviti matches consent securely. It triggers the execution of the trade by the bank.

ACH or B2B cross-border payments use case

A corporation (consent requestor) asks a client (consent provider) to make a cross-border or ACH payment via the client’s bank (credential provider) for services.

- The corporation asks, “Can you make a payment for our services?”

- Customer receives the request and gives consent via Priviti.

- Priviti matches the transaction, parties and consent, and the client’s bank authorises the wire transfer and executes it in ACH/Swift using the Priviti transaction ID as a reference.

- The corporation identifies the wire transfer using the transaction ID and data stored in the Priviti token.

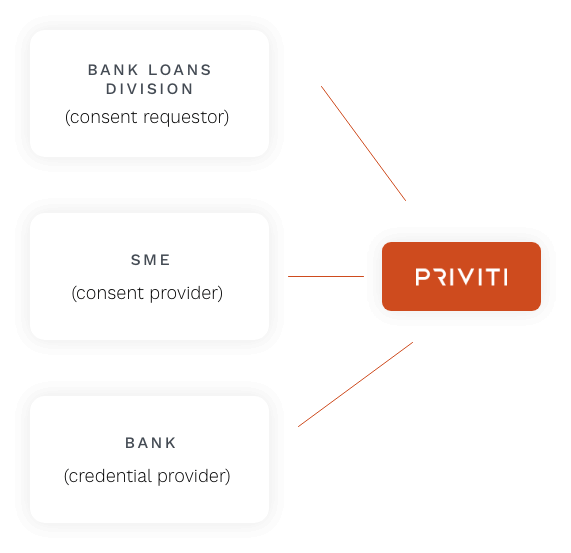

SME underwriting use case

The SME loans division of a bank (consent requestor) requests the transaction history and account information of an SME (consent provider) held by the bank (credential provider) to quote for a loan and to share anonymised account information with a range of underwriters.

- SME loans division of a bank asks the customer, “Do you consent to sharing your transaction history and account information with us and your anonymised data with our underwriters so we can quote for a loan?”

- Customer receives the request via mobile banking app and gives consent via Priviti.

- Priviti matches consent securely. It shares the data with the SME loans division, which shares anonymised data with underwriters.

Contact us

How can we help?

Contact the Priviti team today to learn how

we can help your company manage granular

consent for data sharing and transactions.

we can help your company manage granular

consent for data sharing and transactions.